So is there an ETF that accurately tracks the price of crude? Reading this article it seems not but surely there must be something? http://www.businessweek.com/articles...-with-oil-etfs

Looking back to 2009, if anyone knows, what stocks or funds or etf's did the best at most closely tracking the price of oil?

Results 2,476 to 2,500 of 19601

-

01-14-2015, 08:11 AM #2476

Registered User

Registered User

- Join Date

- Feb 2006

- Posts

- 122

-

01-14-2015, 08:59 AM #2477

Ten Year hit 1.78% today. Below the October low. 0 handle now on the table. 30 year at all time low yield. QQQ and IWM holding up ok today so not a disaster yet.

Bitcoin in complete collapse but no one cares.Last edited by 4matic; 01-14-2015 at 09:36 AM.

-

01-14-2015, 09:59 AM #2478Decisions Decisions

-

01-14-2015, 10:16 AM #2479

Maybe it's because everybody still feels like they're constantly playing catch up? Just struggling to stay afloat. Inflation's risen over the years, costs of services have gone up, yet incomes have stayed relatively stagnant. Heck, I make 20% LESS than I did half a decade ago. My cars are paid off, I live well within my means, yet I always feel broke for some reason. Every time I run the numbers, I always find it kind of perplexing how little I can put away in the end.

-

01-14-2015, 10:37 AM #2480

-

01-14-2015, 10:44 AM #2481

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

-

01-14-2015, 12:03 PM #2482

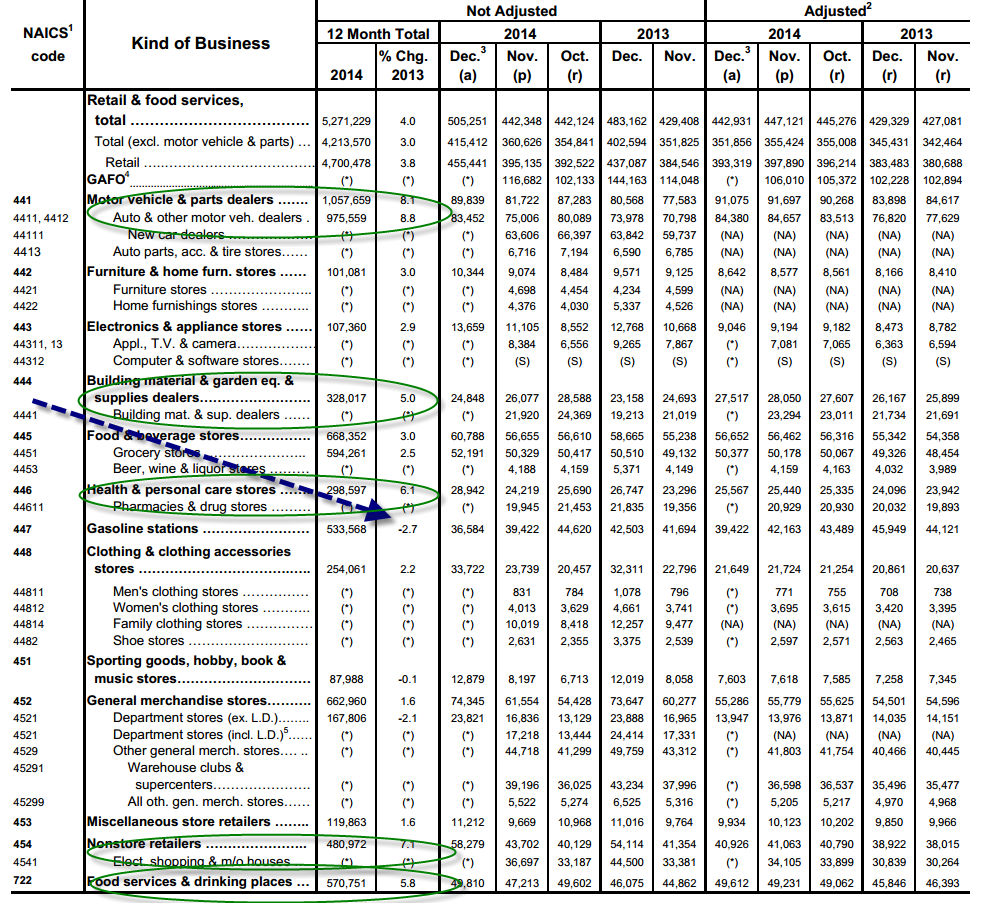

I was more commenting on oct/nov vs December 2014. Most categories are down, when you'd think they should be up right? Improving economy...meh. Lower gas...doesn't matter. Look at 2013. December fairly higher vs November in 2013 which makes sense overall.

Decisions Decisions

-

01-14-2015, 01:31 PM #2483

Bounce in oil is here. Fed comments got it rolling. Gasoline up 09.c

-

01-14-2015, 03:52 PM #2484

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

Turns out this afternoon was NOT a good time to be holding $SCO in size. Oops. $103 - $89 in about 15 minutes.

-

01-14-2015, 05:19 PM #2485

Right at 2pm. Retail sales down in us. Fed was 5 months away...well see if this keeps up, can they raise rates (judging by yc...it doesn't matter what they do, curve is flattening)

Decisions Decisions

-

01-14-2015, 05:43 PM #2486

Sold some bonds today.

-

01-14-2015, 07:14 PM #2487

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

in terms of the adjusted figures that show a retail decline, I'm a little foggy on why the big drop to the adjusted figure. Is deflation from oil factoring into that reduced real $ figure?

#WTI off more than a buck from session highs. Volatility soup.

-

01-14-2015, 09:37 PM #2488

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

food for thought.. http://www.reuters.com/article/2015/...0KN1HY20150114

(Reuters) - U.S. retail sales recorded their largest decline in 11 months in December as demand fell almost across the board, tempering expectations for a sharp acceleration in consumer spending in the fourth quarter.

Economists, however, cautioned against reading too much into the surprise weakness, noting that holiday spending made it difficult to smooth December data for seasonal fluctuations.

"Faulty seasonal adjustments from shifts in holiday spending patterns are probably more to blame for the December decline," said Steve Blitz, chief economist at ITG in New York. "Looking at the last three months, spending is not collapsing."Bricklin Dwyer, a senior economist at BNP Paribas in New York, said fewer post-Black Friday shopping days in November than normal threw off the so-called seasonal factor used to adjust the data, resulting in a lower December sales number.

"For January 2015, this seasonal factor will boost sales by the largest factor since 2006," said Dwyer.

"This combined with the fact that we have seen a massive boost to consumers' wallets as a result of the rapid decline in gasoline prices, suggests that January could be a big month that reverses much of the December drop," he said.Looking over the entire holiday shopping period, sales at many retailers were solid, in sharp contrast to the Commerce Department data.

The National Retail Federation, which looks at a subset of retail sales that excludes automobiles, gasoline stations and restaurants, said 2014 holiday sales increased 4.0 percent from a year earlier, the fastest since 2011.

Separately, the Federal Reserve in its Beige Book said consumer spending increased during the holiday, with "modest" year-over-year gains in retail sales.

"This certainly doesn't support the unexpected drop in retail sales," said Jennifer Lee, a senior economist at BMO Capital Markets in Toronto.

-

01-15-2015, 07:46 AM #2489

Seems the Swiss changed their mind and are willing to risk inflation to get away from the stupid euro. Big reversal. Where can I buy Francs?

http://www.wsj.com/articles/swiss-na...ate-1421315392

-

01-15-2015, 08:57 AM #2490

-

01-15-2015, 10:21 AM #2491

Didn't we blame shitty retail numbers last year on the weather? And now it's less shopping days in November? Isn't that good for December? And lower gas prices helping numbers in January...gas was pretty damn low in December too...good weather...and not only did sales not grow or even stay neutral...they dropped.

It's only one month and certainly could be an abberation. But why the drop? No cool shit to buy? BLS should have a survey in Gear SwapDecisions Decisions

-

01-15-2015, 11:01 AM #2492

I suppose there is theory that a lot of retail sales have been transposed to things like online (apps-content) and it is not accounted for. I know my personal mall traffic indicator (I drive by the mall every day) was down significantly this year and the parking lot was never full.

Today, currency markets froze for a time and trading was suspended in many locations. I believe currency always leads major changes to markets. Is it bullish or bearish equity? I don't know. It's bullish for the DAX, that's for sure.

Strong dollar and lower oil prices will affect SP500 earnings and with retail sales questionable draw your own conclusions on the outcome. At this point it's anyone's guess.

All time low on ten year at 1.43% looks almost certain.

-

01-15-2015, 12:03 PM #2493

Dax is up because the euro is getting pummeled with Swiss cent bank coming out of nowhere and taking away the cap on franc/euro. Repercussions globally just due to the speed with the euro fall.

Decisions Decisions

-

01-15-2015, 12:53 PM #2494

From: CME Global Command Center

Subject: 6SH5 Limit Move Alert

6SH5 Swiss Franc March 15 Futures went limit bid for a third time at 03:47:50 CT. If the market is limit bid after 5 minutes, there will be a two minutes halt for all associated futures and options. After the 5 minute period, price limits will be expanded to level 1600.

The following link provides specific information:

http://www.cmegroup.com/rulebook/fil...on-limits.xlsx

-

01-15-2015, 01:26 PM #2495

just want to say that my firm is hiring an experienced CFP. Location: Bend, OR. PM for details.

Let me lock in the system at Warp 2

Push it on into systematic overdrive

You know what to do

-

01-15-2015, 01:41 PM #2496

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

Sold $PVA at the open, still short $SCO. Looking to restart supplier positions in the next few weeks. I'm going to buy any dips into $30s and try again to build up an actual position rather than dicking around with shorting.

Don't have any faith in a bottom forming right now but the bounces off new lows should be violent with a lot of position turnover. More squeezes like yesterday ahead, followed by renewed heavy shorting on $7 pops like we just saw.

-

01-15-2015, 02:46 PM #2497

Q's bouncing off a four month low with INTC earnings today. James Grant predicted the Swiss would do this. He's an entertaining writer:

"In the past seven years central banks have conjured more than $10 trillion of digital wampum. Still, prosperity eludes them," he writes in the Financial Times. The Federal Reserve's balance sheet has ballooned to $4.5 trillion.

"The juxtaposition between clouds of electronic scrip on the one hand, and ultra-low bond yields on the other, is the financial non sequitur of 2015," Grant says. "If it does not concern the stewards of capital today, it may torment them tomorrow."

History will not treat central banks kindly, Grant says. "The heirs of today's bondholders will read with amazement the history of post-2008 monetary policy," he predicts.

"They will marvel at the faith of a non-church-going people in the mystical powers of central bankers. They will mourn the destruction of the wealth their forebears entrusted to feckless governments at barely positive rates of interest — or, in the cases of Switzerland, Germany and Japan, literally negative.

"Sooner or later, there will be a recession and a wicked bear market in stocks — there always are. How will the central bankers then respond? In outdoing even what they did before, what will they do to your money?"

-

01-15-2015, 04:36 PM #2498

At least Grant hasn't sold out to Fox news. There's some old school wasp integrity behind that bow tie and hornrims.

-

01-19-2015, 08:32 PM #2499

If there was ever a doubt that commodity prices are manipulated ....

big ass oil tankers

I know I bought OIL recently, but fuck those guys.

-

01-19-2015, 09:15 PM #2500

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

Past few days have been more or less building up to Tuesday/Wednesday. Should get a move up to $50 or $44 in the next two days. Fundamentals seem largely bearish, technicals are bearish across the board. Perfect situation for a big decline. Or a crowded short squeeze

. I'm going to either have sushi this week in celebration or cancel the new bong purchase and eat leftover ham.

. I'm going to either have sushi this week in celebration or cancel the new bong purchase and eat leftover ham.

What's at steak:

Last edited by Bromontana; 01-19-2015 at 09:45 PM.

Similar Threads

-

Who voted for Bush/Cheney in '00 or '04?

By Bud Green in forum General Ski / Snowboard DiscussionReplies: 281Last Post: 04-14-2006, 11:44 PM -

Risotto Recipes - What you got?

By skiaholik in forum The Padded RoomReplies: 41Last Post: 03-29-2006, 06:03 PM -

Did American Ski Company get delisted from the stock market?

By Free Range Lobster in forum General Ski / Snowboard DiscussionReplies: 3Last Post: 09-06-2005, 06:13 AM -

Bear Activists Killed and Eaten by Bears in Katmai

By Lane Meyer in forum TGR Forum ArchivesReplies: 30Last Post: 10-09-2003, 08:43 AM

Reply With Quote

Reply With Quote

Bookmarks