While I don't think fairy dust because price at the pump below $2 is FKNA real. But, this is a worthwhile read which mirrors my opinion (and yours) which agrees with the fugazi part:

The Conventional Wisdom On Oil Is Always Wrong

http://fivethirtyeight.com/features/...-always-wrong/

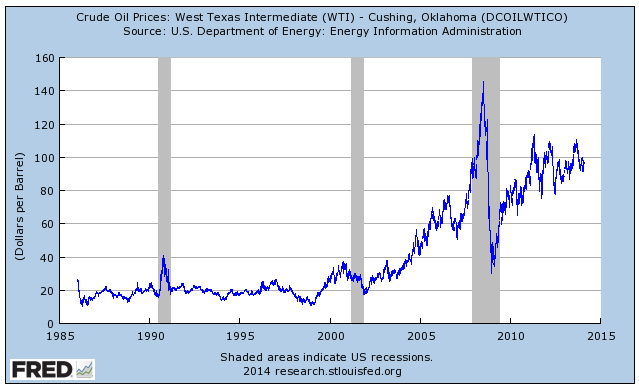

I'm on the record here for lower prices earlier this year based on my chart voodoo and my chart voodoo shows no support for oil and gasoline. Just like speculators drove prices to $170 the price can get easily collapse to $30 or lower. Previous monthly low on Gasoline was .80c in 2009. That's .65c lower than it is now and at .03c per dollar per barrel that puts oil price around $30. The risk is an overshoot on that price when the small producers are forced to throw inventory at hedges.

No bounce in Junk Bonds and Treasury showing good relative strength. Bearish oil. Plus, retail investors have been large buyers of oil related securities:

http://www.cnbc.com/id/102249010

That said, CVX was up today. CVX and XOM are not as reliant on the price of crude oil. Increased gasoline demand will continue to support their earnings, but, I would be very cautious with these stocks after the 10% bounce off the lows.

Results 2,351 to 2,375 of 19601

-

12-29-2014, 11:07 PM #2351

-

12-29-2014, 11:16 PM #2352

-

12-29-2014, 11:35 PM #2353

Thanks guys. I think the lesson here (as usual) is dollar cost average to get in and then play for the Israeli strike on Iran. It's obviously a joke, but you think Putin is gonna take this laying down? He'd sooner sponsor a terrorist strike on Saudi oil fields.

-

12-30-2014, 12:05 AM #2354

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

-

12-30-2014, 12:47 AM #2355

technical analysis is so much more

fun when im drunk.

-

12-30-2014, 08:57 AM #2356

Rod9301

Rod9301

- Join Date

- Jan 2009

- Location

- Squaw valley

- Posts

- 4,975

Cape p/e above 27, and no, it's not good for market timing, but it predicts 10 year returns of about 1% per year.

-

12-30-2014, 12:33 PM #2357

Pretty good pivots on oil, dollar, and gold going in to last trading day.

-

12-30-2014, 01:06 PM #2358

4matic, when to buy SPSU6EP with a long term hold in mind?

Never in U.S. history has the public chosen leadership this malevolent. The moral clarity of their decision is crystalline, particularly knowing how Trump will regard his slim margin as a “mandate” to do his worst. We’ve learned something about America that we didn’t know, or perhaps didn’t believe, and it’ll forever color our individual judgments of who and what we are.

-

12-30-2014, 02:20 PM #2359

IPO price on the ETF (Sym NASD: PSCE) was $26 in 2012 Oil prices were considerably higher then. I went through the holdings and most of the stocks have a similar chart pattern: https://www.invesco.com/portal/site/...productId=psce

An initial position now is not a bad strategy because there has to be a differentiation in some of these stocks. Some will makeit but no doubt some will not. The index had a pretty good bounce along with the rest of the energy stocks in the face of even weaker energy prices. Someone is wrong, either the commodity or the stocks. The bonds are continuing weak.

Right now you are buying on weekly support but the major unknown is none of these companies have reported earnings and outlook since the oil crash. A reasonable strategy if you want to get long would be take an initial position now (before the end of the year) because the new year often marks trend change. Then leg into more over the next six months. Find out when earnings are for the major holdings: BRS and EXH and see what they have to say. I would guess that they will make the next earnings reports dire to cover their asses. It's all going to depend on solvency of their junk financing for each company. If junk refinance rates go up significantly many of these companies will fail regardless of oil price.

-

12-30-2014, 02:55 PM #2360

Registered User

Registered User

- Join Date

- Jan 2005

- Location

- Denver, CO

- Posts

- 1,620

I miss Hugh Conway.

-

12-30-2014, 06:55 PM #2361

Curious to hear what you think of this article:

http://www.truth-out.org/news/item/2...at-20-a-barrel

-

12-30-2014, 08:40 PM #2362

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

Interesting article. High oil prices aren't a civic duty for Saudi Arabia to abide by, however uncomfortable it may be for those that have predicated national or institutional viability on high prices. The general thrust of the article is consistent with what I've come to believe, that future prices will be more reasonable (sub $100) and more accurately reflect the break even point for new swing producers - those with varying, but higher than Saudi prices to extract. It's tough to look at this through a macro perspective because traders have taken over the index.

I chickened out and replaced OIL with SCO (ultrashort), but kept the producers. As noted they seem to be diverging from crude.

-

12-31-2014, 08:15 AM #2363

Could it simply be demographics? Maybe.

http://www.rigzone.com/news/article.asp?a_id=115404

-

12-31-2014, 09:12 AM #2364

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

Zoom out and you get a different question, how soon can developing markets adopt more efficient technology? At what point will poverty reduction cease to outweigh their interest in adopting cleaner tech?

-

12-31-2014, 09:16 AM #2365

Banned

Banned

- Join Date

- May 2010

- Location

- where the rough and fluff live

- Posts

- 4,147

Benny I saw this the other day, thought you might find it useful --

from Paris Review, an interview done November 4, 1986. The novel JR was published 1975.INTERVIEWER

What moved you to write JR?

GADDIS

Even though I should have known from The Recognitions that the world was not waiting breathlessly for my message, that it already knew, and was quite happy to live with all these false values, I’d always been intrigued by the charade of the so-called free market, so-called free enterprise system, the stock market conceived of as what was called a “people’s capitalism” where you “owned a part of the company” and so forth. All of which is true; you own shares in a company, so you literally do own part of the assets. But if you own a hundred shares out of six or sixty or six hundred million, you’re not going to influence things very much. Also, the fact that people buy securities—the very word in this context is comic—not because they are excited by the product—often you don’t know what the company makes—but simply for profit: The stock looks good and you buy it. The moment it looks bad you sell it. What had actually happened in the company is not your concern. In many ways I thought . . . the childishness of all this. Because JR himself, which is why he is eleven years old, is motivated only by good-natured greed. JR was, in other words, to be a commentary on this free enterprise system running out of control. Looking around us now with a two-trillion-dollar federal deficit and billions of private debt and the banks, the farms, basic industry all in serious trouble, it seems to have been rather prophetic.

-

12-31-2014, 09:42 AM #2366

I owned that book, but barely read it. Over my head at the time.

-

12-31-2014, 09:52 AM #2367

Banned

Banned

- Join Date

- May 2010

- Location

- where the rough and fluff live

- Posts

- 4,147

try it again, it's funny as hell. wading through the broken conversation style and the lack of quotation marks or other notes suggesting who talks, that requires a little acclimation, but it's funny enough to bother with pushing through when feeling bogged down at the start.

-

12-31-2014, 10:01 AM #2368

After the four Pynchon novels collecting dust on my shelf.

-

12-31-2014, 11:04 AM #2369

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

Tom Brakke (Research Puzzle): A heavily-analyzed, globally-traded commodity can go down fifty percent in response to relatively modest changes in fundamentals. Therefore, you might want to take the predictions you hear and the models you rely upon with a grain truckload of salt.

-

12-31-2014, 12:07 PM #2370

My guesswork:

The interesting (ironic) thing is that cheap oil will move "that point" further out in time, because any financial incentive to move toward green energy in developing countries will drop dramatically. Developing countries have much bigger fish to fry than moving toward cleaner energy, and if cheap(er) oil is available, I think they will be that much more reluctant to shift toward cleaner and more expensive sources of energy.

Another interesting side effect of the recent drop in oil prices could be that in the long term (5-10 years) it could benefit the companies that got in on the Bakken and Eagle Ford on the ground floor with fracking and horizontal drilling technology, because there will be less incentive to develop similar shale plays throughout the world (and from what I've read there are many). You want a glut, THAT would have caused a glut. But now other countries will think twice before investing in those plays. IMO that might have been one of Saudi Arabia's primary motivations in trying to drive prices down--just to head that off. Long term that sort of worldwide shale play development is a much bigger threat to them than what's going on in the U.S. right now.

I don't have the balls to invest in any of this, I just like to follow it.

-

12-31-2014, 03:41 PM #2371

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

Yeah present chatter of peak oil demand is premature. Demand growth will continue alongside GDP growth for the foreseeable future.

There will certainly be a thinning of the herd with non-traditional producers, though I doubt many of them look at this dip as a good thing long term. It's a price war attacking what Saudi Arabia sees as excess investment in production capacity. Perfectly legitimate position for the Saudis to have. They own 20% of the world's reserves and have supplied more than their share of energy for quite some time. Initiating this price war is not nefarious or amoral, it's a complex re-balancing of the oil market's roles and responsibilities. If the Saudis are simply defending market share the steady reduction or conversion of North American wells will eventually turn around the herd of speculators. The shale revolution in the US increased domestic output by 4 million barrels/day and we now have a global production surplus of approximately 2 million barrels/day. Moderate reductions in production + modest growth in demand and that production surplus is gone. Sure enough, permit applications to drill oil and gas wells in the U.S declined almost 40 percent in November.Another interesting side effect of the recent drop in oil prices could be that in the long term (5-10 years) it could benefit the companies that got in on the Bakken and Eagle Ford on the ground floor with fracking and horizontal drilling technology, because there will be less incentive to develop similar shale plays throughout the world (and from what I've read there are many). You want a glut, THAT would have caused a glut. But now other countries will think twice before investing in those plays. IMO that might have been one of Saudi Arabia's primary motivations in trying to drive prices down--just to head that off. Long term that sort of worldwide shale play development is a much bigger threat to them than what's going on in the U.S. right now.

For the time being though it seems like the break below $54 WTI was met with renewed institutional shorting, so away we go to the $30s.

-

12-31-2014, 05:00 PM #2372Never in U.S. history has the public chosen leadership this malevolent. The moral clarity of their decision is crystalline, particularly knowing how Trump will regard his slim margin as a “mandate” to do his worst. We’ve learned something about America that we didn’t know, or perhaps didn’t believe, and it’ll forever color our individual judgments of who and what we are.

-

12-31-2014, 05:29 PM #2373

Best way to keep Europe from dropping into a deep depression.

-

12-31-2014, 05:35 PM #2374

Well, it might save you something unless the taxation of diesel fuel changes...like here in europe... Before diesel cars got popular

we were used for something like 0.85€/L and few months ago we had 1.6€. What have changed after the oil prices dropped -50%

...Diesel went down to 1.5€...

Well, you still get a much further with the same bang for buck, but now for example the london (and other met mayors) have started

to talk about banning diesel vehicles altogether from entering the city. Interesting point as apparently about 99% of the commodities gets delivered

by diesel vehicles, same that were subsidized 10 months ago in numerous ways...

I have been following this thread for... a long time and I find it damn interesting. Not that I have vested interests but the whole geopolitics thingy..

So if you dont mind, 4Matic and others, might I throw some questions?

Ok.

- Stock market, especially the US is way,way overvalued? Some eurobankers say it is about 20-30% overvalued.

Or is it so that it is the only actual thing that is puffing? And is it only because the low interests/loans?

- Oil. How long will US watch saudis dicking around? Their relationship since OBL has been at least strained, some would say necrotic.

What could the possible repercussions be? Some parts of saudi family apparently have been supporting/growing ISIS and the old Bush era

connections have gone sour. US will prolly do nothing to destabilize The Kingdom..or? Setting free 7+ million of pissed of young men with no

clear agenda..well...you get the point.

- What other "black swans" have you coined up to tip things into a double recession?

The floggings will continue until morale improves.

-

12-31-2014, 06:38 PM #2375

Stock market is the prettiest girl at the dance, and, from all present indications, may even get prettier in '15. Tons of cash in the world seeking yield. Look what's happening with the Shanghai. Now that real estate, the prime depository of the Chinese savings, is going bust, all that money is buying a crooked market. It will end badly, soon. The smart money is flowing into the west, primarily, S&P. Treasuries are totally bubbled, too. Absurd. VUSTX is up ridiculous in the wrong direction. We still, after a period we should have known, are Japan, in a new, well armed version. The American consumer is toast, and the greatest consuming demographic, the Boomers, are literally dying, basically, bankrupt. That will take time, though. Maybe ten to twenty. Saw this today: http://www.rigzone.com/news/article.asp?a_id=115404 which I posted above, and, I know, may be simplistic, but, still, the demographics here should not be ignored. Look at real estate. That's a demographic fueled market that will take two decades to clear.

And really, fuck the Saudis in their smelly asses. And Texas, too, Fuck them into the stone ages they deserve.

Similar Threads

-

Who voted for Bush/Cheney in '00 or '04?

By Bud Green in forum General Ski / Snowboard DiscussionReplies: 281Last Post: 04-14-2006, 11:44 PM -

Risotto Recipes - What you got?

By skiaholik in forum The Padded RoomReplies: 41Last Post: 03-29-2006, 06:03 PM -

Did American Ski Company get delisted from the stock market?

By Free Range Lobster in forum General Ski / Snowboard DiscussionReplies: 3Last Post: 09-06-2005, 06:13 AM -

Bear Activists Killed and Eaten by Bears in Katmai

By Lane Meyer in forum TGR Forum ArchivesReplies: 30Last Post: 10-09-2003, 08:43 AM

Reply With Quote

Reply With Quote

Bookmarks