May slip a bit, but tank? No. Purchase some stock right now if you're able to and enjoy the outcome in 2 years.

Results 2,326 to 2,350 of 19601

-

12-10-2014, 05:22 PM #2326

Registered User

Registered User

- Join Date

- Sep 2014

- Location

- NorCal

- Posts

- 10

-

12-11-2014, 05:10 PM #2327

True but I think right now there are some extenuating circumstances w oil. Bifurcation with us vs Europe and japan- us is improving and the other 2 are wayyy behind. This is nothjng new. But goes to show, I believe, helicopter Ben did a good job jumping into the economy. Europe waited and they're way behind

Dollar will continue to strengthen. Gold will move back down. Fed moving on rates mid/later 2015 and japan/ecb easing makes it a little dangerous for us economy and fed will need to be cautiousDecisions Decisions

-

12-11-2014, 06:25 PM #2328Hugh Conway Guest

lulz. "europe is way behind"

anyways, nice to see how baby bros comng along

Canada’s housing market could be as much 30 per cent overvalued; the share of new mortgages that are subprime is rising rapidly; and Canadian household are already among the most indebted in the rich world. Other than that, what else is there to worry about?

-

12-12-2014, 11:04 AM #2329

Not what I'd call a solid strategy, but I'm still having fun buying bits of silver bullion here and there. It may not be worth much, but at least it will never entirely go poof like people's Enron shares. It's also just kind of fun to have the shiny coins. Retarded, I know, but it's just kind of fun to collect. Wish I had the cash to buy gold back in the good ol' days when it was 200-300/oz.

So now that we're nearing the end of 2014, what are your predictions for stocks to play with in 2015? On another forum, many years ago, we started a fantasy stock market league. No money needed to be spent using the Virtual Trade Tool at http://www.cboe.com/tradtool/virtualtrade.aspx

Maybe we could start up a league? See who's the most skilled, or maybe I'll win with my blindly throwing darts at random stocks strategy. Could be fun. Especially since it's just monopoly money.

-

12-12-2014, 01:29 PM #2330

I know. They will facilitate and vary.

-

12-12-2014, 03:32 PM #2331

Banned

Banned

- Join Date

- May 2010

- Location

- where the rough and fluff live

- Posts

- 4,147

Based upon today's activity, we are seeing a trend toward brflembe mixed with preqbhe for the next 60-90 days

Unless things change at the micro level in which case we shall prognosticate anon

-

12-12-2014, 05:45 PM #2332

Crashes typically start on a Friday. Although, washouts that close on the low and then sell off further after the close have typically marked lows for the last several years. SP500 closed right on support and 50 day MA. I have support at 1920. Could see that next week.

-

12-12-2014, 06:56 PM #2333

Technical analysis...😏

-

12-15-2014, 06:21 PM #2334

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

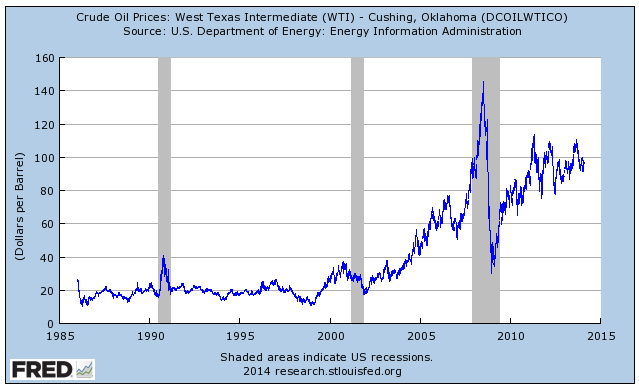

6 month chart looks like $OIL is bottoming out with the accelerated decline/capitulation and the volume shooting up. Think it's a false alarm.. too much momentum and excess supply to expect anything but continuation.

-

12-29-2014, 11:50 AM #2335

Oil bottom out yet?

-

12-29-2014, 12:17 PM #2336

I believe that is a distinct possibility. I read something in the paper today about all sorts of chaos in Libya causing a huge disruption in their exports, thus having an effect on the global market. Prices up today. Hope things rebound fast. Saudis are gonna be pissed as they realize their little scheme failed in the end.

-

12-29-2014, 12:17 PM #2337

-

12-29-2014, 05:40 PM #2338

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

I started in with about 1/3rd position across OIL / PVA / OAS with crude at $56, knowing it will likely be a quarter or more before that portion of the position is profitable. As said before thinking it keeps heading lower, just like the value now regardless of technicals. Will be patient on adding, looking to add another third or half position at $45/bbl.

It's one motherfu**ing crowded trade.

-

12-29-2014, 08:43 PM #2339

Does anyone really think that crude is gonna stay this low for more than a year at most? Greedy oil motherfuckers will find a way to get back into the cash. I can't see how this isn't a perfect opportunity to take up a position in a long-horizon account.

-

12-29-2014, 08:50 PM #2340

This just in: I don't care.

However: I do think that the people looking at cheap gas as a reason to buy a huge fucking truck/other gas guzzler are being retarded. Sooner or later a finite resource will become more expensive. Just because we found a way to stretch it means nothing in the long run.

-

12-29-2014, 09:00 PM #2341

-

12-29-2014, 09:38 PM #2342

Deflation shit is hitting the fan. Capitulation time. The world won't see growth for years, decades. Saudis whip out their dick and say, fuck you, let's see who can handle 50 dollars for how long. Could be a two to three year game of chicken, then, who knows. Meanwhile, major stimulus from pure luck for U.S. and China, two major consumers, and will help Europe from dropping into a fascist depression. Fun times.

-

12-29-2014, 09:45 PM #2343

-

12-29-2014, 09:51 PM #2344

How so? North America figured out a way to extract more oil, albeit at a higher price, through fracking and oil sand extraction. This fruck out the traditional extractors (Saudi Arabia) so they artificially lowered the price of oil by ramping up production and causing a glut, hoping that the resultant drop in $$/bbl would shut down the NA oil producers.

This lower cost of oil (and corresponding lower cost of gasoline in the USA) has spurred an increase in sales of high consumption personal vehicles, like trucks and SUVs, in the last 2 months. That is an unfortunate fact.

The point is that there is still a finite amount of oil. We're just better at getting at it. Some day - maybe soon, but probably not - we are going to be unable to extract more than the year prior. That will be the day of reckoning... especially for the suburbanites buying 3/4 ton pickemup trucks to haul their toys around.

-

12-29-2014, 10:00 PM #2345

We're saying the same thing. My only point was that we didn't all of the sudden find more oil. In other words, we didn't find a way to stretch it. Saudi's are simply dumping to curb competition as you suggest. It'll be back ... the same way housing prices came back. Everyone has a short term memory. I don't even think it's necessary to find the bottom here if you're investing. Just average and put it away for a year from now.

-

12-29-2014, 10:05 PM #2346

OK, but what I should have added in my post is that NA consumption is down quite a bit due to higher CAFE standards in the US. The Chinese decrease in demand has had a large effect as well. We have found a way to stretch the budget in a way, along with increased supply.

Yes, I guess we are going down the same route. Eventually gas prices will rebound, but I don't think it's only because of dumping that it's low.

-

12-29-2014, 10:10 PM #2347

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

As long as crude is being heavily shorted it's not going to rebound. Sounds dumb and simple, but the truth is there's enough speculative capital to drive down the price well past any economic balance point. It could stay below $50 for years if there's a major disruption growth-wise. Short term it could go down another 40% under shorting pressure before enough trades are unwound. Look at the initial spike after dropping to $54 WTI, there was a substantial short cover that pushed it up from high $53s to $59 in less than a day.

Today's price is not a reflection of efficient markets, but rampant speculation on the heels of a moderate supply imbalance and a modest reduction in expected demand. Benny seems to be getting ahead of himself with the deflation angle.

-

12-29-2014, 10:25 PM #2348

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

In terms of medium term 2-10 years it seems that the introduction of a few million barrels per day in US production is enough to bend down the spot price below $100 ($80ish is my understanding). So there is a fundamental reduction in the price one should expect for oil today versus two years ago. For the current market long term scarcity is probably not of much value (as opposed to 2007) with extraction as efficient as it is, the key is cost of production + physical capacity to produce + speculative flavor of the times.

-

12-29-2014, 10:26 PM #2349

Thanks for the insight. To reiterate, my long term bet is that once the trading shenanigans are sorted out (weeks to months) that either efficient markets will resume or speculation will reverse. Obviously I could be wrong but I've got a long horizon and despite how it looks, am not trying to time this. I'm simply looking at a 50% price drop over six months in a critical, yet finite commodity as an opportunity with more upside than down. Specifically, I would hope that would OIL would be back to June levels in ~7 years. If it does, I'll have done as well as historical S&P. 7 years is a long time for oil to be down.

-

12-29-2014, 10:58 PM #2350

observing free range rude

observing free range rude

- Join Date

- Aug 2012

- Location

- below the Broads Fork Twins

- Posts

- 5,771

Unfortunately $50 isn't a crazy price for crude. 4Matic has better info but be careful about using $OIL as a proxy for crude long term. They have to continually turn over near term oil contracts to mimic the spot price. Short term you may slip a % or two but over 7 years it could add up. Something to consider before thinking long term about a crude trade. I've used domestic producers to offset this and add volatility/upside.

Similar Threads

-

Who voted for Bush/Cheney in '00 or '04?

By Bud Green in forum General Ski / Snowboard DiscussionReplies: 281Last Post: 04-14-2006, 11:44 PM -

Risotto Recipes - What you got?

By skiaholik in forum The Padded RoomReplies: 41Last Post: 03-29-2006, 06:03 PM -

Did American Ski Company get delisted from the stock market?

By Free Range Lobster in forum General Ski / Snowboard DiscussionReplies: 3Last Post: 09-06-2005, 06:13 AM -

Bear Activists Killed and Eaten by Bears in Katmai

By Lane Meyer in forum TGR Forum ArchivesReplies: 30Last Post: 10-09-2003, 08:43 AM

Reply With Quote

Reply With Quote

Bookmarks