Maxed 401k, not eligible for pre tax IRAs, interest is not tax deductible. Only downside to paying it down would be that it would leave little reserves as the bulk of my investments are in my 401k or 529.

Results 2,726 to 2,750 of 19621

-

05-06-2015, 02:19 PM #2726

Registered User

Registered User

- Join Date

- Apr 2010

- Posts

- 810

-

05-06-2015, 02:24 PM #2727

Registered User

Registered User

- Join Date

- Apr 2010

- Posts

- 810

I keep thinking I should let my wife pay her loans. It will encourage her to run a more profitable business and I should set a goal to accumulate a pile of money and buy some commercial real estate in the next buying cycle.

-

05-06-2015, 02:46 PM #2728"fuck off you asshat gaper shit for brains fucktard wanker." - Jesus Christ

"She was tossing her bean salad with the vigor of a Drunken Pop princess so I walked out of the corner and said.... "need a hand?"" - Odin

"everybody's got their hooks into you, fuck em....forge on motherfuckers, drag all those bitches across the goal line with you." - (not so) ill-advised strategy

-

05-06-2015, 02:46 PM #2729

If your wife runs a biz, it'll need to be more than emergency money. I'd pay down the 4% debt only to the extent it leaves a sufficient cushion for your wife's biz. When I had a higher overhead practice I always kept around enough cash to weather a bad biz year or two. My practice occasionally brought in a chunk, which I used to pay down debt while maintaining my minimum reserve balance. YMMV re size of reserve, depends on the volatility of the biz revenue. I was pretty conservative setting my minimum reserve because I had some big annual revenue swings.

-

05-06-2015, 03:20 PM #2730Never in U.S. history has the public chosen leadership this malevolent. The moral clarity of their decision is crystalline, particularly knowing how Trump will regard his slim margin as a “mandate” to do his worst. We’ve learned something about America that we didn’t know, or perhaps didn’t believe, and it’ll forever color our individual judgments of who and what we are.

-

05-06-2015, 07:27 PM #2731

Registered User

Registered User

- Join Date

- Apr 2010

- Posts

- 810

I don't comprehend the 6-12 month in the bank comments. Why keep 50-100k in an account earning <1%? Especially w 2 incomes, why not invest it?

-

05-06-2015, 07:36 PM #2732

I am hoping that should read "access to 6-12 months expenses".

"These are crazy times Mr Hatter, crazy times. Crazy like Buddha! Muwahaha!"

-

05-06-2015, 07:43 PM #2733

-

05-06-2015, 11:09 PM #2734

Is the stock market going to tank?

in addition to the above -- Roth IRA tricks those boxes if you qualify. haven't looked in a while but I think the cap is around 180k/married couple. invest 11k/yr and if things get ugly withdraw your contributions with no penalty. downside is that a lot of times shit will get ugly for you when it is for a large group of the population -> you pulling out funds in a market downturn - so there is some risk - but less than other options.

ETA: with the above said, im in the camp that would take the 4% gauranteed return

-

05-06-2015, 11:51 PM #2735

Now I'm no Investment guru, but my family + I have done very well with ETFs. Similar returns and style to a mutual fund, just .2% instead of 2% off your capital. Very liquid.

"4ply is so quiche"

-Flowing Alpy

-

05-08-2015, 02:02 AM #2736

I've never understood this. Stocks can be liquidated in days at worst. Unless you are kidnapped, when are you ever going to need that kind of cash immediately? Put orders in to sell the stocks to guard against a major crash if you want. But if you have blue chip stocks as your asset it isn't that much riskier than cash. At that point its kinda like arguing that you should have $20k in gold and silver and an AK47 in a secret vault in your house "just in case".

-

05-08-2015, 03:06 AM #2737

Yes, many stocks are highly liquid, some less so during certain periods in the market. And stop loss orders are great (unless there is a crash). But you still have some transaction costs, and crossing the spread every time you liquidate a small amount of your holding. And you always have capital risk unless you hedge, which requires more transaction costs and management time. Some people think that "rainy day" funds should never be subject to capital risk. None of this should be read as strong argument in favor. Just discussing pros and cons. I don't care either way - investing and money really bores me these days.

Life is not lift served.

-

05-08-2015, 10:21 AM #2738

I agree but that's case for having cash. You don't want to be forced to sell a "higher yielding" asset in your portfolio when it is down in value. You need short term assets for short term needs.

Personally, I think well managed credit is a better way to handle a cash crunch but it takes considerable assets to make that work. What good does 12 months cash do you if you still have no income after twelve months?

As far as Liquidity. No surprise the credit market took a tumble when APPLE announced a $6b offering. APPL is bigger than most countries entire stock market.

-

05-08-2015, 11:42 AM #2739

Luckily my mentor way back when told me to have the 12+ months income liquid, as my income shit the bed in 2008 and has been 25% of what I use to make these last 7 years. Now that I have burned through the rather substantial liquid savings, I am left wondering, "well now what dip shit"???? Luckily we are debt free (paid off home) and the wife has the great teaching position, but I still need to make $$$ for my sanity. Guess I am going to have to take a regular job at a bank pimping loans and answering to my boss. After being able to come and go as I please forever, this is going to kill me.

Never in U.S. history has the public chosen leadership this malevolent. The moral clarity of their decision is crystalline, particularly knowing how Trump will regard his slim margin as a “mandate” to do his worst. We’ve learned something about America that we didn’t know, or perhaps didn’t believe, and it’ll forever color our individual judgments of who and what we are.

-

05-08-2015, 11:56 AM #2740

-

05-08-2015, 12:00 PM #2741Never in U.S. history has the public chosen leadership this malevolent. The moral clarity of their decision is crystalline, particularly knowing how Trump will regard his slim margin as a “mandate” to do his worst. We’ve learned something about America that we didn’t know, or perhaps didn’t believe, and it’ll forever color our individual judgments of who and what we are.

-

05-08-2015, 12:02 PM #2742

I agree. I am all for an emergency fund, but putting it in the bank seems a waste to me, vs putting it in something like mutual funds. Yes, I know, those could tank, but here's my thinking. A mutual fund is very liquid; no emergency will require you to cough up $20k in 24 hours. If you're very risk averse, a mutual fund that is very conservative will protect your principal and still give you better returns than a bank acct. And if you are less risk averse, invest in a stock mutual fund (I choose index funds). While those could tank and screw your emergency fund, I still think it's a good play.

Assume you start now and invest $20k. Yes, if the market tanks tomorrow AND you need the money next week, you could be screwed. There IS risk. But if you leave the money in there and let it grow, and say in 7 years the market tanks AND you need the money the week after, where are you at? At 7% annual return, you have over $32k. At 8%, $34k. 9%, $36k. 10%, $39k. Even if the market tanks and drops 40%, you are about even with the guy earning 1% in a savings acct.

And the whole point of an emergency fund is a fund that you probably never need. So to me, putting it in the bank is leaving money on the table."fuck off you asshat gaper shit for brains fucktard wanker." - Jesus Christ

"She was tossing her bean salad with the vigor of a Drunken Pop princess so I walked out of the corner and said.... "need a hand?"" - Odin

"everybody's got their hooks into you, fuck em....forge on motherfuckers, drag all those bitches across the goal line with you." - (not so) ill-advised strategy

-

05-08-2015, 12:30 PM #2743

^^^ so this:

Everything has its place. Cash is good if you have a plan for it. But an emergency fund should at least keep pace with inflation (or really your lifestyle). Having a year's salary in cash is literally the opposite of getting a raise, i.e. devaluing a past year's income.

-

05-08-2015, 12:39 PM #2744

Risk free forward 30 year return is now 3%. Risk free forward 5 year return is 1%. Using 7% as a baseline for return is too optimistic imo. If the 40% decline happens in year one you would need more than a decade to recover at 7% annually.

Defining the time frame for an investment is one of the most important considerations.

-

05-08-2015, 12:43 PM #2745

-

05-08-2015, 12:45 PM #2746

For those inclined to go the route of a secure (FDIC-insured) cash deposit emergency fund, I suggest considering a CD (or series of CDs) via an online bank. Search out whoever is giving the best rate. If you have to break the CD term and withdraw early, the penalty is usually something like a forfeiture of the last 6 months' interest.

The reason for a series of CDs: if you do a set of smaller CDs and need to access one or two, you don't forfeit interest on the entire amount. Also, this allows for a CD ladder (as one matures, roll over into a new CD). Spaced out over time, you can have a series of CDs maturing annually, or at whatever interval you plan.

FWIW, we have a series of CDs at an online bank, at around 2.25%, for our emergency fund. It's not 6 to 12 months of living expenses, but it's a cash cushion. This CD rate is better than a 0 to 1% savings account, but not as much return as likely from a bond or stock fund -- but it's 100% secure. Your risk tolerance may vary.

-

05-08-2015, 12:48 PM #2747

/\Hard to beat that for a risk free strategy. good work.

-

05-08-2015, 12:54 PM #2748

I have no idea what you mean by "risk free forward 30 year return", I'm not a finance guy. And besides, nothing I have talked about is risk free, not by a longshot.

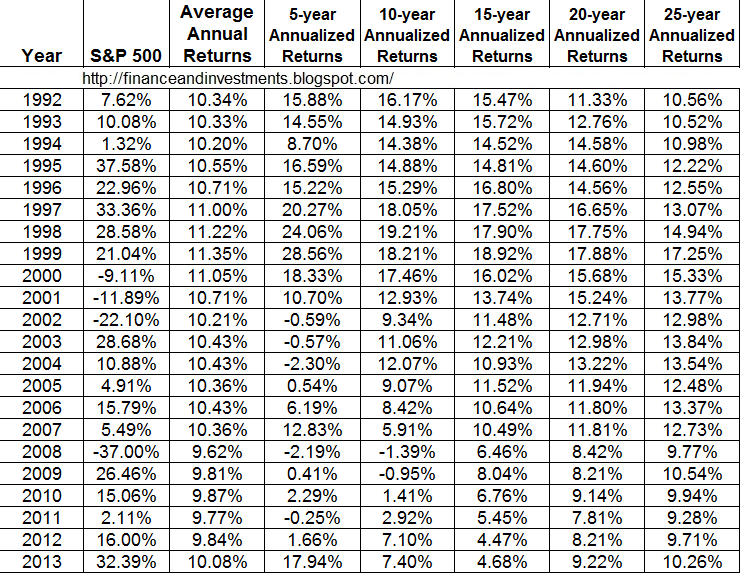

but yes, expecting 7% return may be optimistic. I'm not actually expecting any specific number, just looking to get a good return on a pot of money that is likely to sit around unused for a very long time. But looking at the charts here for the S&P 500: http://financeandinvestments.blogspo...for-s-500.html it seems like 7% is not an awful number to choose. If you look at the 20 year annualized return, which of course would include any crashes within those 20 year periods, there are only 4 years in the last 60 years where the 20 year annualized return is under 7%, and there isn't a single year under 6%.

My point is simply that while crashes happen, and can happen at the worst possible time for you (ie there IS risk), for a long term hold on a pot of money that will likely go untouched, those crashes will be smoothed out by gains during other times, and even if the crash happens at a bad time for you, if that time is at least a number of years from the establishment of the emergency fund, you will still likely be ahead of where you'd be if the money was in a savings acct."fuck off you asshat gaper shit for brains fucktard wanker." - Jesus Christ

"She was tossing her bean salad with the vigor of a Drunken Pop princess so I walked out of the corner and said.... "need a hand?"" - Odin

"everybody's got their hooks into you, fuck em....forge on motherfuckers, drag all those bitches across the goal line with you." - (not so) ill-advised strategy

-

05-08-2015, 01:11 PM #2749

-

05-08-2015, 01:19 PM #2750

Similar Threads

-

Who voted for Bush/Cheney in '00 or '04?

By Bud Green in forum General Ski / Snowboard DiscussionReplies: 281Last Post: 04-14-2006, 11:44 PM -

Risotto Recipes - What you got?

By skiaholik in forum The Padded RoomReplies: 41Last Post: 03-29-2006, 06:03 PM -

Did American Ski Company get delisted from the stock market?

By Free Range Lobster in forum General Ski / Snowboard DiscussionReplies: 3Last Post: 09-06-2005, 06:13 AM -

Bear Activists Killed and Eaten by Bears in Katmai

By Lane Meyer in forum TGR Forum ArchivesReplies: 30Last Post: 10-09-2003, 08:43 AM

Reply With Quote

Reply With Quote

Bookmarks