I’ll let you have that one, I think 175-185 tsla

Results 19,251 to 19,275 of 19581

-

04-04-2025, 05:01 PM #19251

-

04-04-2025, 06:42 PM #19252

It's us against EVERYONE.

Other countries might tax imports from us, one of their biggest or even biggest trading partner.

We chose to tax imports from EVERYONE AT ONCE.

So, all those other guys? They can trade with each other without the extra import taxes.

We don't win this game because the rest of the world can trade with each other without the sand in the gears that is tariffs. We poured all the sand in all our gears and threw in a wrench.

If Trump wanted to be a trade bully, and the man pathologically loves being a bully, he could have picked targets a few at a time.

But no, he had to FIGHT EVERYONE AT ONCE. Trump is a damned fool.

Everyone told us to fuck off because we actually will have to blink first, or its our own funeral. Our tariff policy is so fiendishly self destructive that it only makes sense if from a ignorant foolish bully surrounded by yes men... or if Putin could make a wish about how the US could implode itself. Funny how those things look the same. Originally Posted by blurred

Originally Posted by blurred

-

04-04-2025, 07:01 PM #19253

Markets still expect a lot of the Trump tariffs get reversed in a few weeks. That's the only thing preventing even bigger declines. Prices can go a lot lower if these tariffs stick around

-

04-04-2025, 10:11 PM #19254

Since nineteen forty five, this was apparently the fifth worst two days of trading.

-

04-05-2025, 12:38 AM #19255

Is the stock market going to tank?

This is just the ultimate shooting oneself in the dick move. Completely self inflicted destruction due to one man. Trump and every single person who voted for him are directly responsible for this. It is just beyond stupid, childish temper tantrum level of behavior. Richest most successful country in the history of humanity decides to blow the whole thing up based on lies, and executed with utter incompetence.

-

04-05-2025, 05:52 AM #19256

Historically speaking, the mkt sells off 10% every 2 yrs, 20% every 5.

I have never traded off presidents, wars etc. every time I did, I put myself on the wrong end of the craps table. It’s the people who think they know…that make it lucrative for others. I sold puts for a living to people who may have really known so,m, but the mkt is never that predicable.

Except for Covid, we’ve been straight up for almost 15 yrs. Straight, fucking, up.

The mkt is a basket of thousands of variables, people, economics, etc.

Trade the mkt, not the bullshit. I was leaning short since august. Tariffs were just dumb luck but a reward for not letting greed get me earlier in yr.

-

04-05-2025, 05:53 AM #19257

Registered User

Registered User

- Join Date

- Jan 2025

- Posts

- 129

Congress clearly isn't going to do anything with a veto proof majority. The admin just got a decent jobs report and seems unbothered by stock market declines so until we start seeing actual price increases and job losses I can't see them changing course.

Does anyone know if as presented the tariffs are dynamically recalculated? What happens if country A's production goes to a lower tariff country? Does country B see a tariff increase?

The worst part about this is how regressive it is; the working class and poor are going to get wrecked....

-

04-05-2025, 06:16 AM #19258

Anyone pserious about their portfolio needs to ignore the political infiltrators before they get scared into dumping it all at the bottom. They don’t fucking care if you do, and they don’t care if you lose your shirt.

We saw that during Covid, never saw that guy again. Whatever his name was.

Wait another 10% and start nibbling down. Buy from them.

-

04-05-2025, 08:02 AM #19259

Imo old fashioned stuff like Dodd Graham, PE ratios ( as opposed to just PEG are going to come back in vogue.

From that reversion to the mean POV, markets can easily drop another 10-20% before I would consider buying back in and converting some of that TIPs, cash and other short gains back into long.

And I will certainly not be looking at US stocks quite so favourably unless they have oligopolistic characteristics.

-

04-05-2025, 08:14 AM #19260

lol @ "political infiltrators." How this plays out will be determined by Trump's policy decisions. It's all contingent. If the president's hard line stance on trade moderates, that's one scenario, but otherwise recession corrections don't bottom out with PEs at 20x and earning expectations near at all-time highs.During recessionary bear markets PEs typically bottom more around 15x. Covid and the "V' shaped recovery is an example of the Fed and the federal policy intervening to help the economy. This time, rate cuts are already priced in. We don't know, yet, what policy WRT tariffs looks like in the future

-

04-05-2025, 08:16 AM #19261

So for the people that have not capitulated yet, how far down does it go before you do? Another 10% or 20% inquiring minds want to know. And yeah this is a serious question as my kids are fully invested and losing their asses. I don't say anything because the son-in-law is their financial advisor.

Sent from my moto g stylus 5G (2022) using TapatalkNever in U.S. history has the public chosen leadership this malevolent. The moral clarity of their decision is crystalline, particularly knowing how Trump will regard his slim margin as a “mandate” to do his worst. We’ve learned something about America that we didn’t know, or perhaps didn’t believe, and it’ll forever color our individual judgments of who and what we are.

-

04-05-2025, 08:55 AM #19262

https://www.gurufocus.com/economic_i...p-500-pe-ratio

25.6 before liberation day. Probably 23 on April 4.

S&P PE about 18 is reversion to mean. That's approx 25% lower which feels about right.

This isn't 2008 when us lucky enough to be in cash saw 50% discounts. It doesn't feel like 2008 to me (ie bankers jumping out if windows vibe). This feels more like the slow agony of many cuts.

So let's say step downs of 10 then another 10 then another 10 as downward spiral inducing catalysts come into play.

When the buying public gets dulled to pain then you'll see not a floor but the down trend leveling out.

And watch Buffett. That's what I did: it wasn't rocket science

-

04-05-2025, 09:08 AM #19263

I agree with Lee

3600 in the SP is capitulation to me. I hope to ride my vix to 4100.

But I’ll crack before then, and I have a lot tied up in the vix, and want to roll that back into the big cap tech I sold last summer.

-

04-05-2025, 10:01 AM #19264

A potential problem with playing the VIX in Lee's scenario is a longer slower meltdown doesn't provide the spike needed to profit from it

-

04-05-2025, 10:48 AM #19265

No

-

04-05-2025, 10:57 AM #19266

It’s based on supply and demand. Stock doesn’t have to even move and implied can go up and down. If the MM’s are shorting it, they have finite capital, to take that risk, and it goes up until maybe a big bank steps in wants in.

Vix is still low Bevause all the way up, the pros we’re being forced to buy more, and more, when they are short it, finally, it will pop. That’s still and “if” though.

-

04-05-2025, 11:16 AM #19267

There are lots of ETFs selling the strategy you describe. Those ETFs didn't work circa 2022 because the market stepped down slowly causing their short-dated put and/or call spreads to expire out of the money

-

04-05-2025, 11:17 AM #19268

You’ll know you’ve priced somethjng right, only when goldman and his brother show up to smash it. But it moves until that equilibrium is met. And they do that at the very end.

That’s why information is key, people sell that info. You can rich just piggy backing it. Or could, when it wasn’t a robot.

-

04-05-2025, 11:59 AM #19269

ETFs are customers, not liquidity providers. They have an investor mandate that they cannot deviate from, so they roll the same shit, every month, regardless of mkt conditions. Which I why I said stay away from JEPI right now. They are actually what allows a MM to buy a cheap cals from them, then sell an expensive put, putting on spreads for “positive theoretical edge” and that is why skew exists and put/call parity can get out of whack. And I’ve never met a dude on a desk like that who had more than a degree and good golf game. They are the “sell side” of the biz, not buy side.

Hedge funds are buy side, but off the floor guys who just buy premium, or sell premium, eventually go bust. But if they can get away with it for 5 yrs, rich still.

We’re all dumb money, unless you’re on the deutsche bank desk, or still making markets and seeing what’s going on and putting positions on at the right price and only the right price.

-

04-06-2025, 07:56 AM #19270

Registered User

Registered User

- Join Date

- Oct 2007

- Posts

- 13,582

-

04-06-2025, 08:29 AM #19271

Registered User

Registered User

- Join Date

- Oct 2007

- Posts

- 13,582

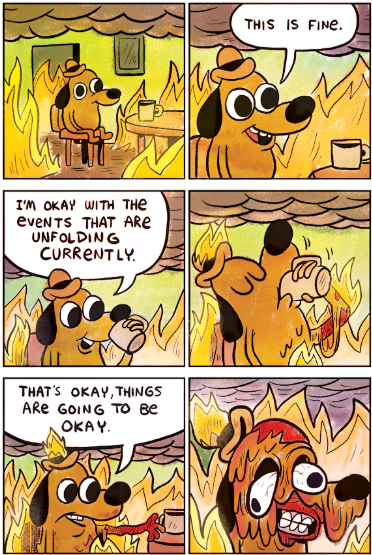

[img]

[/img]

[/img]

-

04-06-2025, 09:46 AM #19272

Registered User

Registered User

- Join Date

- Mar 2008

- Location

- northern BC

- Posts

- 33,935

Didn't anybody sell out ?

Lee Lau - xxx-er is the laziest Asian canuck I know

-

04-06-2025, 10:58 AM #19273

Look, I get this sentiment, but I think it is wrong.

If you listen to Trump, to what the economic advisers he listens to say, they for a very long time (decades) have had an extremely wrong misunderstanding that trade deficits with another country are harmful to America. They truly believe what they are doing is righting a wrong and will make America more prosperous.

edit: broken site. That was supposed to be in response to Name Redacted.

-

04-06-2025, 11:23 AM #19274

Registered User

Registered User

- Join Date

- Mar 2008

- Location

- northern BC

- Posts

- 33,935

I actualy meant sold high so they could buy low isnt Warren Buffet in this position ?

I think trump has zero idea how tarrifs work zero idea or what he is doing I think many Americans have zero idea whats happening or where Canada is

I don't hold any stocks so zero skin in this game money

I just get 5 or 6 DDs every monthLee Lau - xxx-er is the laziest Asian canuck I know

-

04-06-2025, 12:50 PM #19275

Coin bros be gettin mad now too

Similar Threads

-

Who voted for Bush/Cheney in '00 or '04?

By Bud Green in forum General Ski / Snowboard DiscussionReplies: 281Last Post: 04-14-2006, 11:44 PM -

Risotto Recipes - What you got?

By skiaholik in forum The Padded RoomReplies: 41Last Post: 03-29-2006, 06:03 PM -

Did American Ski Company get delisted from the stock market?

By Free Range Lobster in forum General Ski / Snowboard DiscussionReplies: 3Last Post: 09-06-2005, 06:13 AM -

Bear Activists Killed and Eaten by Bears in Katmai

By Lane Meyer in forum TGR Forum ArchivesReplies: 30Last Post: 10-09-2003, 08:43 AM

Reply With Quote

Reply With Quote

Bookmarks