Results 1,876 to 1,900 of 28558

Thread: Real Estate Crash thread

-

04-07-2010, 04:57 PM #1876

-

04-07-2010, 05:16 PM #1877

King of Scots

King of Scots

- Join Date

- Oct 2006

- Location

- Milpitas, CA

- Posts

- 2,805

One way or another, you've got to pay for a place to live. You can rent (and pay any associated costs) or you can buy and make mortgage payments (as well as pay associated costs, like maintenance and property tax). I doubt most people really make a careful comparison, but, in theory, it should just be a matter of doing that and picking the one that works better for you (including consideration of any other relevant factors, such as the value to you of owning the place you live, loss of some flexibility in moving, etc.).

I just don't see debt as inherently evil or enslaving, managed prudently.

-

04-07-2010, 05:55 PM #1878

If you leverage an appreciating asset. Otherwise, it's a fool's game.

Very interesting survey. People love going into hock for a house, and, I guess there's a lot of pent up demand for one or two purchases, after all this. But, they still hate stocks:

http://seekingalpha.com/article/1973...te-bear-market

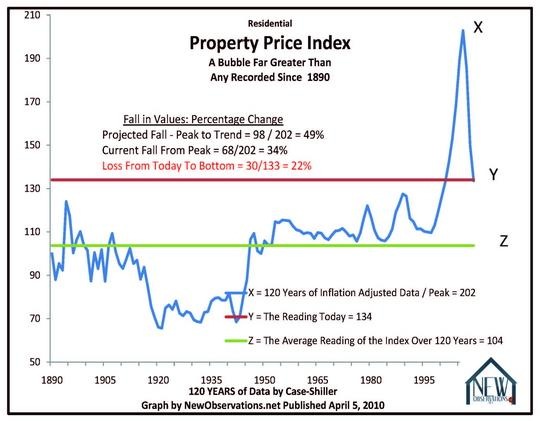

Where we stand relative to the historical mean:

-

04-07-2010, 06:13 PM #1879Hugh Conway Guest

-

04-07-2010, 06:26 PM #1880

King of Scots

King of Scots

- Join Date

- Oct 2006

- Location

- Milpitas, CA

- Posts

- 2,805

-

04-07-2010, 06:33 PM #1881

I feel your pain, and, I'm not talking down, because I'm looking at a lease, but, since we're talking about prudent decisions in personal finance, yes, the best decision is to save enough cash for a low mileage used car. Like the '07 Miata I just saw on Craigs with 25,000 miles and he was asking 16,000

-

04-07-2010, 06:42 PM #1882

King of Scots

King of Scots

- Join Date

- Oct 2006

- Location

- Milpitas, CA

- Posts

- 2,805

Benny, you know we're nearly the same age, right? I'm not describing my (recent) personal experience. My last three vehicles (all new): cash, cash, financed about a third in my wife's name, for whatever benefit that provides her credit score. You didn't address my hypothetical. I'd say paying cash for a likely clunker to drive your 10, 15, 20, 30 miles to work, just because that's what you can afford to pay cash for, probably isn't a prudent decision in personal finance in that situation.

More generally, the decision even with a depreciating asset is one of making the appropriate economic comparison. For instance, paying cash isn't a costless exercise, you know: there's an opportunity cost associated with separating yourself from that money. And, there are considerations like the one I tried to illustrate above.

-

04-07-2010, 07:00 PM #1883

Why? I don't get what you're saying. It is the most prudent. Bottom line, you should be buying a slightly used, simple, gadget free Japanese or Korean (long lasting) and well guaranteed (Korean) car or truck. Anything else is spending too much money. I understand why people spend more money, which is basically for status, fashion, or taking out a ridiculous loan to have the status and fashion NOW, but it's an awful financial decision.

-

04-07-2010, 07:29 PM #1884

King of Scots

King of Scots

- Join Date

- Oct 2006

- Location

- Milpitas, CA

- Posts

- 2,805

You don't get what I'm saying because you keep projecting your narrow preferences on to it.

I also have preferred to buy Asian (Mazda and Toyota, but I'd buy Honda and probably some others). That's based on my perhaps superficial "Consumer Reports" type understanding of the car market, though. I doubt the reasonable choices are as limited as you suggest. For starters, in my experience, buying slightly used Toyota doesn't save you much at all over buying new, I assume because of the perceived quality and reliability. The conventional wisdom that a vehicle is a sharply depreciating asset in the first few years does not hold nearly as true with Toyotas (and probably other reliable vehicles).

I'll try one more time. Buying a $1K or $2K car just because that's all the cash you have right now is not necessarily a more prudent choice than putting that money toward financing something more expensive. And not buying a vehicle may not be a viable option (e.g., you have a lengthy work commute).

Edit to add - And there are considerations other than your obsession with those who seek to live beyond their means. Buying new generally affords more options regarding options, for instance. Benny, you really need to stop thinking that what you prefer is what everyone should prefer.

-

04-07-2010, 07:46 PM #1885

I'm not saying that. I'm not above it all here. What I would prefer is two cars, a ragtop for summer and an all purpose all wheel drive for winter and other stuff. That would be a lot of fun, and kinda worth it. But, that's ridiculous when one is trying to justify it with your accountant. It is not a smart thing to do with your money to buy any depreciating asset with credit. It's the opposite of what you should do with your money. You should be buying appreciating assets with cash. I understand where you're coming from, and, since my car is very old, I may have to lease a new one because my savings have been depleted with very poor tax withholding decisions hitting me where it hurts. But, I'm not going to sit there signing those papers telling myself it's a wise financial decision. Much wiser is going on Craigs and grabbing a low milage Outback for cash, of getting a decent deal at the dealer with the same cash for an Outback with a warranty.

Hey, go out and buy that Porsche or Lexus, they're cool, but, don't come crying to me when the price of pet food goes up when you're "retired". Talk to any Boomer stuck in their MacMansion that they are paying a big loan for that is underwater. What are their future prospects if things don't bounce back in their lifetimes?

-

04-07-2010, 07:52 PM #1886

King of Scots

King of Scots

- Join Date

- Oct 2006

- Location

- Milpitas, CA

- Posts

- 2,805

-

04-08-2010, 12:06 AM #1887

-

04-08-2010, 05:28 PM #1888

People are going to spend all the money they have or can borrow: that is axiomatic. It's not good or bad, it's just how things are.

What I'm saying is that artificially making money cheap isn't a net benefit, because it simply raises prices. Someone who already owns a house says "Great! I can refi and save $200/month!" Someone looking to buy just sees the price go up by $20,000 because the lower interest rates let them afford a higher monthly payment.

And the person hoping to avoid debt gets totally screwed, because the availability of cheap money has raised prices so high that it is impossible to afford anything at all without going deeply into debt.

So yes, in an environment of cheap money, you will never have anything unless you are willing to go into debt. I'm not faulting anyone for their decision to go along with that, because that's how the game is played right now. But you also have to understand the consequences, which is that you are owned by whoever owns your debt -- and by keeping money cheap, we have created a nation of debt slaves.

MD9: you've found an area in which houses are cheap enough to buy either with cash, or with a very small amount of debt relative to the cash they can flow once you put in the sweat equity to fix them up. I respect you for that, because you're going to make a bunch of money in a smart way that doesn't screw people over: instead of just flipping stuff you don't even touch, you're providing tasteful, nicely appointed places for people to live in. I'd much rather live in a house you remodeled than any of the generic white/beige/neglect places I've rented over the years.

-

04-09-2010, 05:49 PM #1889

Bring on cheap Colorado mountain housing!

http://www.denverpost.com/ci_14841331?source=email

"Already this year in Pitkin County, there have been 25 foreclosures, compared with six this time last year — then a record. Grand County has logged 48 foreclosure filings through mid-March, close to the annual total of 2007.

Back in 2007, a resort homeowner in financial trouble could easily sell for at least what was owed. Today, resort counties are weathering 50 percent or greater declines in real estate sales from the high times of 2006.

"Demand for real estate has just dried up," said Ryan McMaken, an economist and director of community relations for the Colorado Division of Housing."

-

04-09-2010, 06:22 PM #1890

lots of jobs in dc

and no land left

glad I don't own property west of denver all the way to the west coast

-

04-09-2010, 07:36 PM #1891

-

04-09-2010, 07:53 PM #1892

-

04-14-2010, 02:14 PM #1893

I call bullshit

I call bullshit

- Join Date

- Dec 2006

- Location

- Bay area, cali

- Posts

- 1,895

lots of inventory in some areas still...

Distressed sales are not going away. In fact they are on the rise nationally with short sales and bank-owned (REO) sales accounting for 29% of all sales in the US in January, the highest level since April 2009.

The findings, published in a First American Core Logic report, highlight Oakland as the one Bay Area city to score highly in the share of distressed home sales rankings. Sixteen percent of homes sold in Oakland in January were short sales.

Among the largest 25 markets surveyed, Riverside, CA, had the largest percentage of distressed sales in January (62%), followed closely by Las Vegas (59%) and Sacramento (58%)

The top REO market was Detroit where the REO share was 48%, followed by Riverside (47%) and Las Vegas (45%). San Diego's short sale share was 19% in January, making it the highest ranked short-sale market, followed by Sacramento (18%) and Oakland (16%).

RealtyTrac currently lists 5,424 homes currently in foreclosure in Oakland -- ranging from multi-million dollar behemoths in the hills to modest homes priced under $50,000 in the International Blvd neighborhood.

The First American report did find, however, that the more severely hit markets are seeing the biggest year-over-year declines in distressed sales -- down by more than 10 percentage points in Oakland, San Diego, Los Angeles and Sacramento for example.In markets with more moderate levels of distressed sales, the distressed share was relatively flat compared to the year ago levels

Read more: http://www.sfgate.com/cgi-bin/blogs/ontheblock/detail?entry_id=61257&o=2&rv=1271275812086>a=comme ntslistpos#commentslistpos#ixzz0l6ivG9KZ

-

04-14-2010, 03:51 PM #1894

Outstanding credit just jumped by $400B in 1 month as bad loans are brought on the banks' books to be unloaded. Not even close to a real estate bottom, but it's a good sign that banks are going to start unloading houses at 40-50 cents on the dollar instead of sitting on them.

Commercial real estate detonation spinning up too. Deflation ho!

-

04-15-2010, 08:01 AM #1895

Utah foreclosure activity increased 75 percent from the first quarter of 2009, the highest annual increase among states with top-10 foreclosure rates and giving it the nation’s fifth highest state foreclosure rate. Foreclosure filings were reported on 10,756 Utah properties, a rate of one in every 88 housing units and an increase of 21 percent from the previous quarter.

http://www.realtytrac.com/contentman...=9&itemid=8927

I agree with the CMBS market blowing up but it might still take some time. It's likely going to end up in courts well before it all blows up. Once some precedence has been set in the courts regarding Tranche Warfair, we will hopefully see the end of EXTEND AND PRETEND and subsequently a fire sale of commercial real estate.

Multifamily has been holding up pretty well in the strong markets. Still doing new deals and selling old ones. Cap Rates are at reasonable levels of 7%-9% on performing properties. The sales at 5% caps was a greedy game of hot potato and worked great if you didn't get caught.

I am still renting a dirt cheap place cause I don't need a "home" as I am never home. I've been looking for 4 families but we are still well over 10 times gross income

I am amazed at how the strong the 2-4 unit Multi family market has held up. It's definitely the Tax Credit so things are going to start getting interesting, I hope.

A 4 unit property in a decent area outside of Boston, not great not ghetto, with an NOI of $30,000 has an asking price of $600,000. That's nuts in my mind. The After tax benefit is around $1,500 annually. That's less than my standard deduction gets me now.

Am I wrong in thinking things will get better here (prices go down)?

-

04-15-2010, 08:29 AM #1896

I think, ultimately, the real estate market's famous "tanking" was the best thing to happen to real estate.

Things were just getting WAY too crazy. Housing values being driven up by speculation....banks selling mortgages to almost anybody and their dog that had a name, barely checking one's ability to pay; people buying multiple properties for nothing more than the seeking of a quick, profitable "flip", in essence thinking of land as nothing more than another commodity with which to make a profit from.

The confluence of all those tendancies will ALWAYS result in an unsustainable "bubble" market. Many of the people who lost their "shirt" in the market, DESERVED losing their shirt. I am glad the damn bubble popped. I wish it would have happened sooner.

People who value land as nothing more than a market commodity with which to derive a profit, have zero respect for the land, and deserve losing their shirts.

I feel bad for many of the young families that got caught up in the collapsing market...being foreclosed out of their homes, but many of these families KNEW they were biting off more than they could ultimately chew.

I can only hope that we'll get back to a mindset based upon "buying within your means".

-

04-15-2010, 09:09 AM #1897

Well the banks are no longer issuing liar loans at the moment. Just listening to the WAMU hearings really brings home the fact, that the lenders were out of control. I sure hope some of these bankers end up in jail. That Killinger prick needs some time behind bars.

But yes, home prices need to get back in line with the average American's income."We don't beat the reaper by living longer, we beat the reaper by living well and living fully." - Randy Pausch

-

04-15-2010, 05:35 PM #1898

Crack Shack, or Mansion?

http://www.crackshackormansion.com/

-

04-15-2010, 05:42 PM #1899

that's funny thanks

-

04-15-2010, 05:42 PM #1900

King of Scots

King of Scots

- Join Date

- Oct 2006

- Location

- Milpitas, CA

- Posts

- 2,805

Reply With Quote

Reply With Quote

Bookmarks