In a word, yes. Middle of the road MBS on my screen now that are running 60% 60+ days delinquent. 90% of those are going to default. Shadow inventory huge. No-bids for foreclosures even at 50% off. $8K credit ending. Slosh going to zero. The stock market is not the economy, especially given that the runup is all government backed leveraged HFT and not retail operations. Interest rates under ZIRP literally have nowhere to go but up. FFR to 6% means an instant 30% drop in all residential. If we go Volcker to get out of this and get an FFR 10%, that's another 60% drop. From HERE.another 20-30% drop in real estate? Are things going to get that much worse?

I'm looking at several 2br2ba houses in my area that I'm looking to buy in cash when they hit $60K, as that will represent a 60% drop.

Anyone who thinks we've "bottomed" deserves to lose whatever money they have at risk.

Because you can pretend on your balance sheet to have a $200K loan that is cashflowing. Sell the house for $100K and you can't pretend to have an income stream anymore.how does unloading real estate at a loss expose or exacerbate a bank's insolvency?

Results 1,776 to 1,800 of 28565

Thread: Real Estate Crash thread

-

03-10-2010, 11:43 AM #1776

-

03-10-2010, 12:03 PM #1777

I call bullshit

I call bullshit

- Join Date

- Dec 2006

- Location

- Bay area, cali

- Posts

- 1,895

Who has money at risk? When i bought my house, i put 3.5 down on a loan from my 401K. The government then gave me that money right back on my tax returns and i repaid my 401K loan. The seller (bank) covered my closing costs. I guess i did pay for my appraisal and inspection. So i am assed out of the 700-800 bucks there.Anyone who thinks we've "bottomed" deserves to lose whatever money they have at risk.

My house payment is less than ive been paying in rent, so i actually have more money in my pocket monthly. I have no money at risk here and neither does anyone else who buys a house like i did. The only ones at risk here are the banks. Or am i missing something?

-

03-10-2010, 12:09 PM #1778

I call bullshit

I call bullshit

- Join Date

- Dec 2006

- Location

- Bay area, cali

- Posts

- 1,895

if people are still sittin on the sidelines your crazy. I got a house with no money out of pocket. That wont be the case when the tax credit expires. On top of that, the government pays me money at the end of the year to own my house.

Or, i could be a renter, paying more a month and not getting any free money.

-

03-10-2010, 12:10 PM #1779

I'm talking about the "shadow inventory" that is not cash flowing, and the owners that have stopped making payments and are requesting short sales (also not cash flowing). Why don't they get those off their books ASAP?

$60k 2br/2ba homes on the front range where is "your area"?

The killer awoke before dawn.

where is "your area"?

The killer awoke before dawn.

He put his boots on.

-

03-10-2010, 12:14 PM #1780

-

03-10-2010, 12:38 PM #1781

Really. Sure, your mortgage may be less, but what about taxes, insurance, utilities, maintenance, upkeep...? Not to mention the value of your time to do all of this.

And if you used the $8K credit, you do know that the median home price on low to middle homes increased by exactly $8K, don't you? So you overpaid by exactly $8K.

Not yet, but I'm positioning to buy one with a cashier's check when they get there. And I'm renting a house for less than a house payment on a similar house anyway.$60k 2br/2ba homes on the front range

You do. You're on the hook to pay off a loan (liability) on an asset that is losing value.Who has money at risk?

Because those loans are packaged into an MBS that is on the banks' books at par. The loss that they would take by selling it and refactoring the MBS via payout is less than simply sitting on the house and eating the fact that the borrower stopped paying two years ago.Why don't they get those off their books ASAP?

Secondly, there's this little gem:

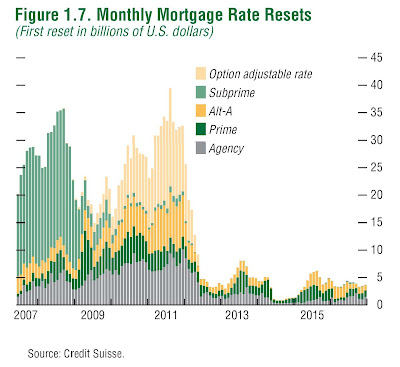

That first spike in resets is what got us here now. That second spike is coming, and it's just as big, except now the RE market is less able to weather it. Buy a house now? No way.

-

03-10-2010, 12:52 PM #1782

I call bullshit

I call bullshit

- Join Date

- Dec 2006

- Location

- Bay area, cali

- Posts

- 1,895

Sorry i should have been more clear. My mortgage + my taxes (i pay my taxes in escrow) are less than i paid in rent. There is no maintenance, i pay 500 a year for home warranty which covers everything that could break in my house. My insurance is 700 a year an comes right out of my check monthly (58 bucks). utilities are no different then when i was renting. Ive always rented houses and had to pay all of my utilities. Same goes for upkeep, nothing has changed. I still have to mow my lawn.Really. Sure, your mortgage may be less, but what about taxes, insurance, utilities, maintenance, upkeep...? Not to mention the value of your time to do all of this.

I guess 10 years or so down the road i'll have to paint my house, thats about it. its tile roof, ill be long gone before that needs to be replaced id imagine. They last like 50 years.

Or i could walk from this loan and all i take is a credit hit. Im in california, its my primary. ive got friend upon friend who has already done this and they are getting along just fine in life, hehe.You do. You're on the hook to pay off a loan (liability) on an asset that is losing value.

Either way, do whatever you'd like. I just think that anyone that wants to buy a house should probably do it before the tax credit expires. If you want to be a renter, more power to you. Maybe for your situation it was better. For mine, it was a better decision to buy a house and i wanted a place to call my own to raise my family in.

-

03-10-2010, 12:53 PM #1783

In a system of fractional reserve banking, your money isn't actually in the bank: it's been lent out. To make things simple, let's say you had $200K "in the bank," and the bank has lent out approximately $188K of that to Joe Blow so he can buy a house.

Under the special rules that banks are given by our government, even though Joe has your money, the bank is allowed to pretend it's still there for you -- because Joe is going to pay it back someday, and under the special rules banks get to use but you don't, that's the same thing.

But what if Joe stops making payments? Then all the bank can do is foreclose on Joe's house and sell it. If Joe's house was still worth $188K, the bank would get your money back and everything would be fine.

Now let's say Joe's $188K house, bought with a zero-down option ARM, is actually worth about $120K. Well, that doesn't matter as long as Joe's still making payments, because Joe is still on the hook for $188K plus interest, and the bank is still allowed to pretend that your money is there instead of in Joe's house.

But what happens if the house isn't worth $188K *and* Joe stops making payments? What happens if Joe has only made $15K worth of interest-only payments, the house is only worth $120K, and it costs them $15K to get through the foreclosure process? Then the bank is suddenly in debt for $73K -- because they owe you $73K that they can't pretend is ever going to be paid back.

That is why there is so much "shadow inventory" -- mortgages that aren't being paid but aren't foreclosed on, either. As long as the banks don't let these houses back onto the market, they can pretend that they're still worth the amount they were mortgaged for, and they can still pretend to be solvent. If they actually let these houses be sold, though, they would have to say "Joe's house isn't worth $188K anymore, it's only worth $105K after our expenses, and now we are going to have to come up with $73K which we don't have -- because in our wonderful system of fractional reserve banking, we get to take your money, lend it out, and keep the interest while pretending you still have it."

And guess who gets to cover that loss? We, the taxpayers. Yes, it's a gigantic scam: banks get to lend our money out at a profit, and if they lose money doing it, we pay to cover the loss so we can get OUR OWN MONEY back.

-

03-10-2010, 01:19 PM #1784

Registered User

Registered User

- Join Date

- Jan 2005

- Location

- Denver, CO

- Posts

- 1,620

They are out there. They need tons of work but they are there. HUD sales are the best source. Just last week I lost out on a house for $35k. Of course, it needed another $35k to make it habitable and was basically under I-70. Next week I might bid on a duplex (3 bed each) for 150k in the West Colfax area.

Oh yea, and shame on you for lobbing up a softball for Spats to go all italics and bold FRACTIONAL RESERVE BANKING rant crazy.

-

03-10-2010, 01:30 PM #1785

yeah sorry about that...I should have known that was going to come

I guess the $60k homes are not that unfathomable...an area I drove through the other day then decided to check out on zillow is covered with solds from 40-70, and all the for sales are 150+. Talk about missing the boat! Also, coreshot, keep in mind that you will need to buy just before the bottom in the area you are watching. When there is enough data showing that the bottom has hit in your area, the investors will have already swallowed it up and regular joes like us don't have a chance.The killer awoke before dawn.

He put his boots on.

-

03-10-2010, 01:45 PM #1786

-

03-10-2010, 05:19 PM #1787Exactly. Walking on the loan is a smart business decision if prices fall to the point where you could rent your house for less than the mtg payment. Me, I already know that I'm renting the house for cheaper than I could buy it, so I'm on the other side of that trade anyway.Or i could walk from this loan and all i take is a credit hit. Im in california, its my primary. ive got friend upon friend who has already done this and they are getting along just fine in life, hehe.

BTW, you do know if your loan is "recourse" or not, right?

For those reading, Spats is 100% wrong on fractional reserve banking. Banks do not lend out customer deposits, nor do they create money from thin air. Banks are legally empowered to create saleable assets known as mortgages, which must be backed by customer deposits held in the vault at the reserve ratio. If your ratio is 10:1, then in order to write a $200K mortgage, the bank must keep $20K in the vault or on deposit at the Fed to satisfy capital requirements.In a system of fractional reserve banking, your money isn't actually in the bank: it's been lent out.

Banks do not "lend out our own money", they can create assets which may or may not be worth what they say they are worth, and they are currently incentivized to keep this obscured as long as possible.Last edited by coreshot-tourettes; 03-11-2010 at 09:42 AM.

-

03-11-2010, 12:03 AM #1788

I call bullshit

I call bullshit

- Join Date

- Dec 2006

- Location

- Bay area, cali

- Posts

- 1,895

non-recourse.Exactly. Walking on the loan is a smart business decision if prices fall to the point where you could rent your house for less. Me, I already know that I'm renting the house for cheaper than I could buy it, so I'm on the other side of that trade anyway.

BTW, you do know if your loan is "recourse" or not, right?

either way, it really doesnt matter. its my home. Im honestly not concerned one way or another what the place is worth or will be worth. Im stashing plenty of money away in my 401k and my kids college fund so my house has no bearing on how ill be living 15-30 years from now. It wasnt an investment. Im now renting a house from myself. if the value drops oh well. if it rises, then great, more money down the road.

-

03-11-2010, 10:20 AM #1789

Ok, I ain't real smirt, but this seems kinda close to spats description just done in banker speak with some detail added.

So banks have to have some small percentage in reserve and they call the financial instrument or 'saleable asset' that is the collateral of my house and he likelihood I'll pay the loan back a ‘mortgage’. I don’t see how having 20k in reserve helps the loan holder much if I walk from 200k they loaned me and they can only sale my house for 100k. And doesn’t the bank then take that money from the sale of my mortgage and invest it and loan it to make money for themselves? Sure, they’re not technically loaning my money, as they have very little of it. They are selling an the idea that my mortgage is pretty sure future money and then using those proceeds to both make money and make new loans, right?

The bottom line is it's still a house of cards that is dependent on property values and the financial stability of the borrower. Because of ridiculous loan practices values were falsely inflated. And as I understand it, the mortgages themselves were repackaged and overrated by the companies that rate them. So the buyers of this debt were essentially lied to. Values went down, those falling values contributed to people losing their jobs and the house of cards has fallen. Seems like either was you slice it, it's an ill-conceived formula based on some shaky assumptions.

So school me if I’m way off-base. But the fractional reserve banking system seems like a risky proposition to begin with. And it’s what we were told to trust. It's what rating companies told the buyers of debt to trust. And we did. And it failed us all.

-

03-11-2010, 10:54 AM #1790

A lot of pure real estate investors never trusted or used the ratings companies and knew full well there was a heap of shit in the form of a bubble and these AAA assets werent really that safe. Didnt stop a lot of them from riding the wave of rising values until it went down quite a bit, but they knew the risks at least and arent surprised. Even Benny knew it was coming. If youre buying houses as an investment, and if you trust the ratings agencies, you do it at your peril. And when you lose...so be it.

If you buy a house for 300K and expect to make payments on that house at an assumed 300K, if the value is suddenly 250K- how are you losing? The 300K was fine before right? You havent lost anything, youre still making payments on your 300K house. Just like before.

If you bought it as an investment then youre shit out of luck and got caught holding the steaming plate of shit. Which happens all the time- there are risks in ivesting in anything. No free money. If you need to sell the house at 250K, you can buy a cheap but somewhat equitable house to replace it.

As for the fractional banking...the value of houses doesnt directly affect what gets paid off and how the bank covers your deposit. Indirectly, though, the value of houses causes people to walk on mortgages, which effects the value of the bonds. There is a fairly high allowance for people walking- this is all profit in times where people dont walk OR prepay. The last year has really really put a stress on this, at a minimum. A lot of banks are going out of business. I dont know what the huge secrecy thing with banks being solvent vs insolvent is too- many large ones were, and needed bailouts. No secrecy. Theres also no secrecy in the hundreds of banks that have failed so far. Small banks that dont make headlines across the country when they go down, but that hold a numbers of these loans on their books.

At the same time many many banks are doing fine. They did not invest heavily in mortgages, and some did so only with the highest credit score out there- people who apparently, on average, seem to give a fuck about things like paying back money they borrow. A lot of them learned from the S&L crisis, and get many things off their books as quickly as possible. Bank Loans used to be an asset class reserved for the balance sheet of a bank, its now sold to third parties (pensions, investment management firms, mutual funds, etc).

Im not saying banks are fine out there, Im actually saying you can see the banks that are knee deep in this shit. Dont invest in them, they have been dropping like flies. Deposits are backed by FDIC. But while blaming banks for offering the vehicles for this to happen, whats up with the general free pass for people walking on mortgages? Or people who truly invest in property because it only goes up?Decisions Decisions

-

03-11-2010, 12:09 PM #1791

That is a completely false statement, and you know it. I'll demonstrate that below.

The bank is allowed to "create saleable assets" = CREATE MONEY. Where did those "saleable assets" come from? From whom did the bank purchase those "saleable assets"? From nowhere: they simply created them, as you said.

"The process by which banks create money is so simple that the mind is repelled." (John Kenneth Galbraith) No economist of any school -- Keynesian, monetarist, Austrian, or otherwise -- disputes the fact that fractional reserve banking creates money by issuing loans. I don't know what you're trying to prove here.

Oh, come on. You know as well as I do that the reserve requirement on checking accounts is only 10% in theory. In practice, banks are allowed to do a "nightly sweep" of your money into savings accounts, which have ZERO reserve requirements. Therefore, the effective limit on bank lending is always the capital requirement, not the reserve requirement -- and this requirement is far, far less than 10%.

If our readers want to learn about capital requirements, Tier 1 and Tier 2 capital, Basel I and II, etc., Wikipedia isn't the worst place to start:

[ame]http://en.wikipedia.org/wiki/Capital_requirement[/ame]

That's a breathtaking bit of Newspeak and you know it. What happens when those "assets" the bank creates aren't worth what the bank says they're worth? Answer: the depositors lose their money -- or, with FDIC-insured deposits, the government, i.e. the taxpayers, i.e. all of us, lose our money.

Seriously: you're a smart guy and you know better. Are you one of those "Real Bills" fruitcakes? I can't think of any other reason you would be going against a fundamentally obvious truth that every single economist accepts, including the ones that can't agree on anything else.

-

03-11-2010, 12:44 PM #1792

I agree with Spats on this one...thats why they have runs on the banks back before FDIC...people know the money is tied up in shitty stuff and want to get theirs before its all gone. These mortgages are sort of the present day "shit". The banks do lend out our money. Whose money would they lend out?

At the same time, I think the FDIC provides a decent backstop for depositors, although nothing is foolproof. Nothing in econ, investments, life, is foolproof. The whole system- businesses, mortgages, banking, trade, needs cooperation. I just think the consumer in this case isnt keeping up their collective end of the bargain in this situation, not leading to values of housing to drop, but to start walking from mortgages or otherwise defaulting. To say nothing of individual banks, because each one is different in lending practices and portfolio construction. But overall theyre in the mess as well.Decisions Decisions

-

03-11-2010, 01:02 PM #1793

Without the secondary mortgage market, our real estate market would look a lot more like feudal Europe, than the US you see today. That is all...

pmiP triD remroF

-dna-

!!!timoV cimotA erutuF

-ottom-

"!!!emit a ta anigav eno dlroW eht gnirolpxE"

-

03-11-2010, 01:25 PM #1794

Creating a saleable mortgage is no different than you or I building a house. We do not "create money" when we build a house, and the bank does not create money when they write mortgages. We both use our labor and capital to create an asset with value.

You are correct in talking about sweeps. I was merely trying to simplify in order to explain reserve ratios. Some countries have greater T1C ratios, some have less. Sweeps allow you to lend more, this is correct.

Depositors do not lose a dime if the mtgs are written at a sane 80% LTV - not 120% LTV as has been the case. Depositors only lose money when the value of the underlying asset is below the value of the mtg against it. And if banks were liquidated the instant their liabilities exceeded their assets, no one loses money, even in a no-FDIC world.

Look, we're on the same side. But I think you've watched "Money as Debt" one too many times.

-

03-11-2010, 02:04 PM #1795

Yep, this little fact along with all the other bullshit out there will likely create a big problem by 2011. I mean how long can the banks maintain the growing "Shadow Inventories" before the whole industry of cards fails? I for one have 0 cash in US banks at this point and really wish my wife would let me sell our RE.

Never in U.S. history has the public chosen leadership this malevolent. The moral clarity of their decision is crystalline, particularly knowing how Trump will regard his slim margin as a “mandate” to do his worst. We’ve learned something about America that we didn’t know, or perhaps didn’t believe, and it’ll forever color our individual judgments of who and what we are.

-

03-11-2010, 02:18 PM #1796Hugh Conway Guest

-

03-11-2010, 06:33 PM #1797

Not true. Believe it or not, there were mortgages taken out at the peak that were traditional 20 down and 15 or 30 year duration. Since many many houses are now valued at 50% less than they were at that time (Vegas, Florida, Inland California, Phoenix, and counting), those people have lost everything, and are now thinking of walking. We're talking about substantial sums in the above 500000 market, right? They have to feel like fools, because they were doing it smart and traditional and safe, right? I don't think so. As Cramer described above, it was and is much smarter to jump in with as little money down as possible, and that is sanctioned directly by your tax dollars this very week. Read this and weep: http://blogs.wsj.com/developments/20...price-decline/

But Cash is King right now, if you have to buy. Avoid any kind of debt, and swoop in and buy from the creditors, that's where you'll get the best deal, and they're going to get better over the next few years. Never buy a house when rates are so low, anyway. A half of a point, which you know is coming right around the corner, will take 10% of the selling price.

-

03-11-2010, 07:07 PM #1798

Let me guess. You're young, too young to remember a time of doing a simple 15-30 year with money down at a local bank was normal. That was a time when millions and millions of families built suburbia after WW2, using that finance model. And, you work in the financial industry, because you actually think that the world revolves around securitization and the other shell games your industry has invented over the last thirty years, and, even though it has done NOTHING good for the average schmuck in the end, it has enriched all the middlemen and 3 card monte players with billions of dollars playing their scams. Dovetails nicely with the scare tactics I still hear, that, if we weren't raped a few years ago to support the corrupt banks and politicians who serve them, there would have been another "depression". They actually argue, even to this day, that they "saved" us from total ruin. We need them, they tell us. Fucking Orwellian.

Last edited by Benny Profane; 03-11-2010 at 07:31 PM.

-

03-11-2010, 11:13 PM #1799Hugh Conway Guest

Oh - Brock - Unemployment payments are paid for by corporate payroll taxes. i.e. they come out of compensation. The rate is indexed in part to how many workers you've laid off (hence SUTA dumping) so no, unemployment isn't an individual bailout.

Well, I guess you could call it that if the banks weren't fighting a similar tax to pay for their bailouts

-

03-11-2010, 11:28 PM #1800

I'm beginning to think Benny is one of the smarter pizza delivery drivers out there.

Reply With Quote

Reply With Quote

Bookmarks